EV Tax Credit 2024: Everything You Need to Know!

As the world shifts towards cleaner and more sustainable forms of transportation, electric vehicles (EVs) are gaining popularity. The US government is actively promoting the adoption of EVs through initiatives such as the Electric Vehicle Tax Credit. In this article, we will discuss the Federal EV Tax Credit in the USA for 2024, including eligibility criteria, the amount of the credit, qualified vehicles, how to claim it, and address common questions.

The EV tax credit, also known as the EV credit, is a nonrefundable tax credit available to taxpayers who purchase qualifying electric or plug-in hybrid vehicles. Nonrefundable tax credits reduce your tax liability by the corresponding credit amount. This means that the credit can significantly reduce the amount you owe in taxes, but you will not receive any excess as a tax refund.

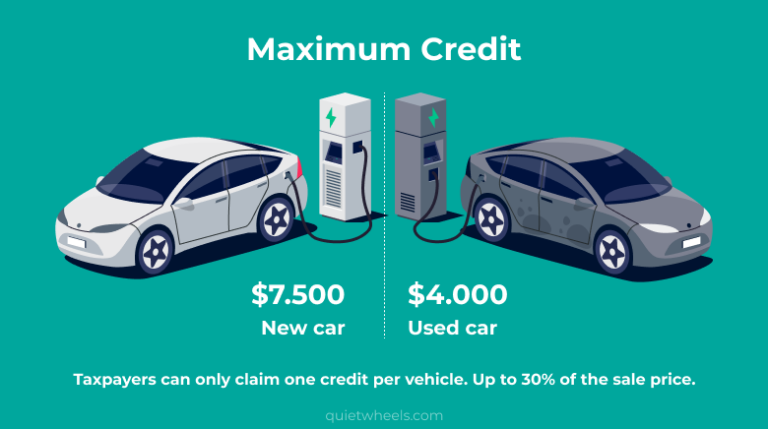

The tax benefit, which has been recently modified by the Inflation Reduction Act for the years 2024 to 2032, allows for a maximum credit of $7,500 for new EVs. Used EVs can receive a credit of up to $4,000, which is limited to 30% of the sale price. Taxpayers can only claim one credit per vehicle.

Who Qualifies for the EV Tax Credit?

If you purchase a new qualified plug-in EV or fuel cell electric vehicle (FCV), you may be eligible for a credit of up to $7,500 under Internal Revenue Code Section 30D. The rules for this credit have been changed by the Inflation Reduction Act of 2023, specifically for vehicles bought between 2024 and 2032.

This credit is available to both individuals and businesses. To qualify, you must ensure that the vehicle is bought for personal use and not for resale. Additionally, it should be primarily used within the United States.

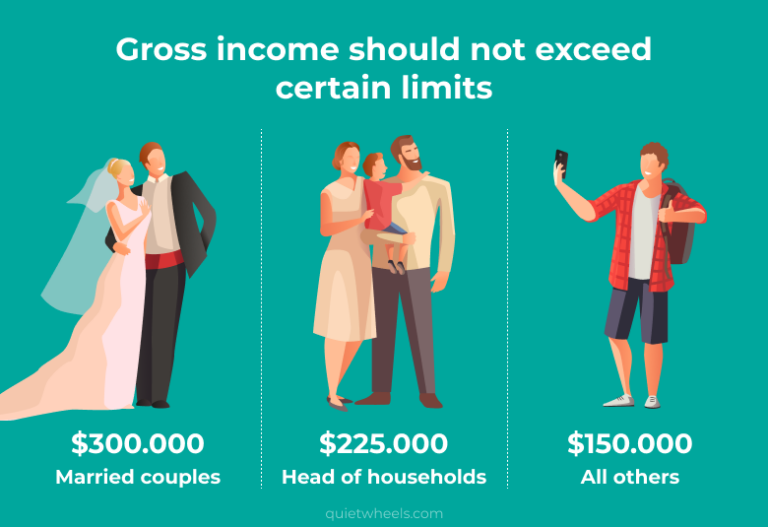

Furthermore, your modified adjusted gross income (AGI) should not exceed certain limits:

- $300,000 for married couples filing jointly

- $225,000 for heads of households

- $150,000 for all other filers

New cars

| Tax-filing status | Modified adjusted gross income |

|---|---|

| Single | $150,000 |

| Head of household | $225,000 |

| Married, filing jointly | $300,000 |

| Married, filing separately | $150,000 |

You can calculate your modified AGI from either the year you receive the vehicle or the previous year, whichever is lower. If your modified AGI falls below the specified threshold in either of these two years, you can claim the credit. It's important to note that this credit is nonrefundable, meaning you cannot receive more in credit than you owe in taxes. Additionally, any excess credit cannot be carried over to future tax years.

Used cars

| Tax-filing status | Modified adjusted gross income |

|---|---|

| Single | $75,000 |

| Head of household | $112,500 |

| Married, filing jointly | $150,000 |

| Married, filing separately | $75,000 |

Credit Amount

The credit you receive depends on when you put your vehicle into service, regardless of when you purchased it.

For vehicles put into service between January 1 and April 17, 2023:

The base amount for the credit is $2,500. An additional $417 is given for vehicles with at least 7 kilowatt hours of battery capacity. Beyond 5 kilowatt hours, an extra $417 is provided for each kilowatt hour of battery capacity. The maximum credit amount is $7,500. On average, the minimum credit will be $3,751, which includes the base amount of $2,500 plus three times $417, representing a vehicle with the minimum required 7 kilowatt hours of battery capacity.

For vehicles placed into service on or after April 18, 2023:

In order to qualify for a credit, vehicles must meet the existing criteria mentioned earlier, as well as comply with the new regulations concerning critical minerals and battery components. If a vehicle meets the critical minerals requirement alone, it can receive a credit of $3,750. Similarly, if a vehicle meets the battery components requirement alone, it can also qualify for the same credit amount. However, if a vehicle meets both requirements, it is eligible for a higher credit of $7,500. Vehicles that do not meet either of these requirements will not be eligible for any credit.

Qualified Vehicles

To be eligible for the Federal EV Tax Credit, a vehicle must meet the following requirements:

- Battery Capacity: The vehicle must have a battery capacity of at least 7 kilowatt hours (kWh).

- Gross Vehicle Weight Rating (GVWR): The GVWR of the vehicle should be less than 14,000 pounds.

- Qualified Manufacturer: The vehicle must be manufactured by a qualified manufacturer. However, Fuel Cell Vehicles (FCVs) do not need to be made by a qualified manufacturer to qualify for the credit.

- Final Assembly: The vehicle must undergo final assembly in North America.

- Critical Mineral and Battery Component Requirements: Starting from April 18, 2023, the vehicle must also meet critical mineral and battery component requirements, ensuring it meets specified criteria for these components.

The eligibility of the sale for the EV Tax Credit requires the following conditions:

- New Vehicle Purchase: The vehicle must be purchased new.

- Seller Reporting: The seller is obligated to report necessary information to both the buyer and the IRS at the time of sale. This includes reporting the buyer's name and taxpayer identification number to the IRS.

It's important to note the manufacturer's suggested retail price (MSRP) limits for the vehicle:

- Vans, Sport Utility Vehicles (SUVs), and Pickup Trucks: The MSRP cannot exceed $80,000.

- Other Vehicles: The MSRP cannot exceed $55,000.

The MSRP represents the manufacturer's suggested retail price for the vehicle, encompassing the cost of manufacturer-installed options, accessories, and trim. However, destination fees are excluded from the MSRP. The actual price paid for the vehicle may differ from the MSRP.

For relevant details about the vehicle, such as weight, battery capacity, final assembly location (identified as "final assembly point"), and the Vehicle Identification Number (VIN), consult the vehicle's window sticker.

How to Claim the Credit

In order to receive the credit, you must complete and submit Form 8936, which is titled "Qualified Plug-in Electric Drive Motor Vehicle Credit (Including Qualified Two-Wheeled Plug-in Electric Vehicles)," along with your tax return. Make sure to include your vehicle's Vehicle Identification Number (VIN) on the form.

Seller information required for tax credit claims

Before leaving the dealership with a new electric vehicle (EV), it's essential to ensure that you have specific documents required for claiming the Federal EV Tax Credit on your taxes. Sellers are obligated to provide taxpayers with a comprehensive report containing vital information about the vehicle, and this report must be furnished to the taxpayer at the time of the vehicle's purchase. Make certain that the report includes the following details:

- Name and Taxpayer Identification Number (TIN) of the seller

- Name and TIN of the taxpayer who is purchasing the vehicle

- Date of sale and the actual sales price of the vehicle

- Confirmation of the maximum tax credit that the vehicle is eligible for

- The Vehicle Identification Number (VIN) of the electric vehicle

- The battery capacity of the electric vehicle

- Verification that the taxpayer is the original user of the vehicle

- A statement of declaration from the seller, made under penalty of perjury, certifying the accuracy of the provided information

Having these essential documents will ensure a smooth process when claiming the EV Tax Credit on your taxes and help you maximize the benefits of adopting a clean and environmentally friendly electric vehicle.

Credits for New Electric Vehicles Purchased in 2022 or Before

If you purchased a new, qualified plug-in electric vehicle (EV) in 2022 or earlier, you may be eligible for a clean vehicle tax credit of up to $7,500 under Internal Revenue Code Section 30D.

The credit amount is calculated based on the vehicle's battery capacity. For vehicles with a battery capacity of at least 5 kilowatt hours (kWh), the credit equals $2,917. Additionally, there is an extra $417 credit for each kWh of capacity over 5 kWh.

However, it's important to note that the maximum credit you can claim is $7,500. The credit is nonrefundable, meaning you cannot receive more on the credit than you owe in taxes. Any excess credit cannot be carried forward and applied to future tax years. In other words, the credit can only be used to reduce your tax liability for the year in which you claim it.

Who Qualifies

Purchasing a qualified new car or light truck may make you eligible for a credit of up to $7,500. This credit is open to both individuals and businesses.

To qualify for the credit, you must purchase the vehicle for your personal use, and it should not be intended for resale purposes. Additionally, the vehicle must be primarily used in the United States.

Qualified Vehicles

To be eligible, a vehicle must meet the following criteria:

- Have the capability for external charging.

- Have a gross vehicle weight rating (GVWR) that is below 14,000 pounds.

- Be manufactured by a company that has not sold more than 200,000 electric vehicles (EVs) in the United States.

For vehicles purchased after August 16, 2022, there is a new requirement regarding final assembly

If you purchase a qualified electric vehicle between August 17, 2022, and December 31, 2022, the same eligibility rules apply as before, but now the vehicle must also undergo final assembly in North America.

To determine if your specific vehicle meets the assembly requirements, you can refer to the Department of Energy's Electric Vehicles with Final Assembly in North America page. On this page, you have two options to check:

- Use the VIN Decoder tool under "Specific Assembly Location Based on VIN" to confirm the assembly location for your particular vehicle.

- Review the list of qualifying Model Year 2022 and early Model Year 2023 electric vehicles under "For Vehicles Purchased before January 1, 2023."

How to Claim the Credit

To request the credit for a vehicle acquired in 2023, you must submit Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit (Including Qualified Two-Wheeled Plug-in Electric Vehicles), along with your 2022 tax return. Remember to include your vehicle's VIN in the form.

For Vehicles Purchased Before 2023

If you didn't get a chance to claim a credit for purchasing an electric vehicle before 2023, there's still a way to do so. Simply file an amended return for the tax year in which you acquired the vehicle, and you may be eligible to claim the credit. The credit for qualified 2-wheeled plug-in electric vehicles expired in 2023. If you purchased a 2-wheeled vehicle in 2022 but started using it in 2023, you might still be able to claim the credit for that year. However, if you bought it after 2022, you won't be able to claim the credit.

Used Clean Vehicle Credit

Starting from January 1, 2024, if you purchase a pre-owned electric vehicle (EV) or fuel cell vehicle (FCV) from an authorized dealer for $25,000 or less, you may qualify for a used clean vehicle tax credit (also known as a previously owned clean vehicle credit).

The credit amount is 30% of the purchase price, with a maximum credit limit of $4,000. Please note that this credit cannot be refunded and cannot exceed your tax liability.

Furthermore, any excess credit cannot be carried forward to future tax years. It's important to mention that purchases made prior to 2024 are not eligible for this credit.

Who Qualifies

Under Internal Revenue Code Section 25E, you may be eligible for a credit when purchasing a previously owned, qualified plug-in electric vehicle (EV) or fuel cell vehicle (FCV), including cars and light trucks.

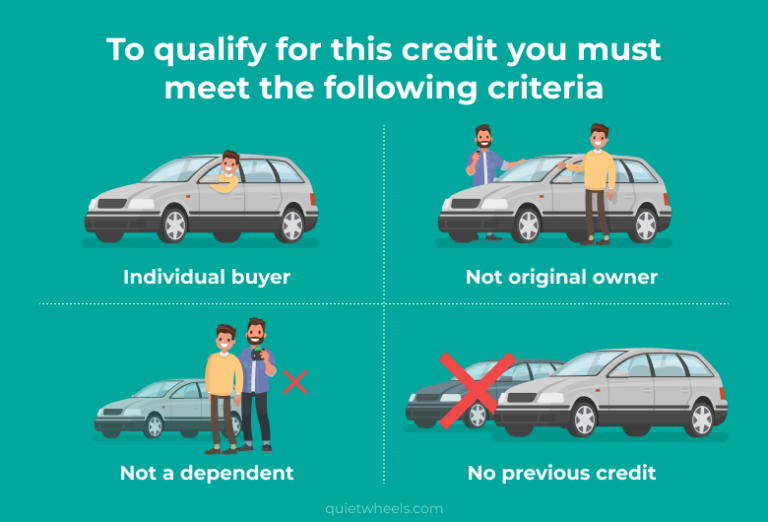

To qualify for this credit, you must meet the following criteria:

- Individual Buyer: You must be an individual who purchased the vehicle for personal use and not for resale.

- Not Original Owner: You should not be the original owner of the vehicle.

- Not a Dependent: You must not be claimed as a dependent on another person's tax return.

- No Previous Credit: You must not have claimed another used clean vehicle credit within the three years before the purchase date.

Additionally, your modified adjusted gross income (AGI) must not exceed the following thresholds:

- $150,000 for those filing jointly or surviving spouses.

- $112,500 for heads of households.

- $75,000 for all other filers.

You have the option to use your adjusted gross income (AGI) from either the year you receive the vehicle or the preceding year, whichever is lower. If your income falls below the threshold for either of these two years, you are eligible to claim the credit.

Qualified Vehicles and Sales

To qualify for the tax credit for previously owned electric and fuel cell vehicles, the vehicle must meet the following requirements:

- Sale Price: The vehicle's sale price must be $25,000 or less.

- Model Year: The vehicle must have a model year that is at least two years earlier than the calendar year when it is purchased. For instance, if the vehicle is purchased in 2023, it should have a model year of 2022 or older.

- Previous Transfer: The vehicle must not have been transferred to a qualified buyer after August 16, 2023.

- Gross Vehicle Weight Rating (GVWR): The GVWR of the vehicle should be less than 14,000 pounds.

- Vehicle Type: The vehicle must be an eligible fuel cell vehicle (FCV) or plug-in electric vehicle (EV) with a battery capacity of at least 7 kilowatt hours.

- Use in the United States: The vehicle should primarily be used in the United States.

To ensure that the sale qualifies for the federal tax credit, it is important to purchase the vehicle from a dealer. Additionally, for qualified used EVs, the dealer is responsible for reporting the necessary information to you at the time of sale and to the IRS.

The required information includes:

- Dealer's name and taxpayer ID number.

- Buyer's name and taxpayer ID number.

- Sale date and sale price.

- Maximum credit allowable under Internal Revenue Code (IRC) Section 25E.

- Vehicle Identification Number (VIN), unless the vehicle is not assigned one.

- Battery capacity.

A dealer is considered to be a person licensed to sell motor vehicles in a state, the District of Columbia, the Commonwealth of Puerto Rico, any other territory or possession of the United States, an Indian tribal government, or any Alaska Native Corporation.

How to Claim the Used Clean Vehicle Credit

To claim the used clean vehicle credit, you must fill out Form 8936, also known as the Qualified Plug-in Electric Drive Motor Vehicle Credit form (including Qualified Two-Wheeled Plug-in Electric Vehicles and New Clean Vehicles). Make sure to file this form with your tax return for the year you took possession of the vehicle. Remember to include the VIN on the form.

Vehicles Eligible for the Federal Tax Credit

| Model | Retail Price Cap | Credit |

|---|---|---|

| 2024 Cadillac Lyriq EV | $80,000 | $7,500 |

| 2022-23 Chevrolet Bolt EV | $55,000 | $7,500 |

| 2022-23 Chevrolet Bolt EUV EV | $55,000 | $7,500 |

| 2022-24 Chrysler Pacifica PHEV | $80,000 | $7,500 |

| 2022-24 Ford Escape PHEV | $80,000 | $3,750 |

| 2022-24 Ford F-150 Lightning EV | $80,000 | $7,500 |

| 2024 Honda Prologue | $80,000 | $7,500 |

| 2022-24 Jeep Grand Cherokee 4xe PHEV | $80,000 | $3,750 |

| 2022-24 Jeep Wrangler 4xe PHEV | $80,000 | $3,750 |

| 2022-24 Lincoln Corsair Grand Touring PHEV | $80,000 | $3,750 |

| 2024 Nissan Leaf EV | $55,000 | $3,750 |

| 2023-24 Rivian R1S EV | $80,000 | $3,750 |

| 2023-24 Rivian R1T EV | $80,000 | $3,750 |

| 2023-24 Tesla Model 3 Performance EV | $55,000 | $7,500 |

| 2023-24 Tesla Model X EV | $80,000 | $7,500 |

| 2023-24 Tesla Model Y EV | $80,000 | $7,500 |

| 2023-24 Volkswagen ID.4 EV | $80,000 | $7,500 |

Questions & Answers

To be eligible for the new EV tax credit, your income must be below specific thresholds, and the vehicle you plan to buy must meet various IRS specifications, such as price caps and manufacturing guidelines.

To get the EV tax credit, you must purchase a qualifying electric vehicle and meet the eligibility criteria specified by the IRS. When filing your taxes, complete the appropriate tax form and provide the necessary information, such as the vehicle's VIN, to claim the credit.

Individuals and businesses who purchase qualified electric vehicles (EVs) meeting IRS specifications and have income below certain thresholds qualify for the EV tax credit.

To qualify for the EV tax credit, the vehicle must have a battery capacity of at least 7 kWh, a GVWR below 14,000 pounds, and be manufactured by a qualified manufacturer. It should undergo final assembly in North America and meet critical mineral and battery component requirements since April 18, 2024. The purchase must be new, and the seller must report required information to the buyer and the IRS at the time of sale, including the buyer's name and taxpayer identification number.

To qualify for the $7,500 EV tax credit, you must purchase a new electric vehicle that meets the IRS specifications, including battery capacity and manufacturer requirements. Additionally, your modified adjusted gross income (MAGI) should be below certain limits. The credit amount gradually reduces after a manufacturer reaches a specific sales threshold, and it is nonrefundable, meaning you cannot receive more credit than your tax liability.

To file for the federal EV tax credit, purchase a qualifying electric vehicle, obtain Form 8936, fill out the form, calculate the credit amount, and file your tax return by the deadline. Keep necessary documentation. Note that the credit is non-refundable for personal vehicles but can be carried forward for business assets. There are income limitations for eligibility. Consult a tax professional or refer to the latest IRS guidelines for specific details.

The tax credit is accessible to individuals and businesses. To be eligible, the vehicle must be purchased for personal use, not resale, and primarily used in the USA. Additionally, income limits are set at $300,000 for married couples filing jointly, $225,000 for heads of households, and $150,000 for all other filers.