The Guide and Stock Market about Top Electric Car Companies in the USA

In the USA, the electric vehicle (EV) sector is rapidly evolving, driven by both new companies and established leaders. These innovative firms are transforming the automotive industry with advanced EV technology. Their growth is changing vehicle manufacturing, promoting sustainable practices, and attracting investors interested in green solutions. This shift towards electric cars highlights a major change in transportation trends, focusing on eco-friendly practices, technological progress, and sustainable mobility in the USA's EV market.

The electric car market in the USA is competitive and innovative. Many companies and new startups are constantly improving electric mobility. These companies are key to the economy and set global automotive trends with their cutting-edge electric vehicles. Their stock performance shows how eco-friendly technology is improving, making investing in the EV sector a good choice. This article looks at their progress, challenges and impact on the future of the US automotive industry.

Tesla, The Top USA Electric Car Company

Tesla, Inc. was founded in 2003 by Martin Eberhard and Marc Tarpenning. Under CEO Elon Musk, Tesla has become a leading innovator in the field of electric vehicles (EVs). Based in Austin, Texas, the company represents American ingenuity in EVs and renewable energy. Tesla's integrated approach to design, manufacturing, and direct sales, supported by more than 127,000 employees, has boosted its stock value and cemented its leadership in the global EV industry. Tesla continues to lead the U.S. EV market, pushing technological boundaries and setting industry standards.

Tesla's diverse and ever-evolving product range has been a game-changer in the automotive sector, featuring innovative electric vehicles like the Tesla Model Y, Model 3, Model X, and Model S. Each model in their lineup is designed with unique features and capabilities, catering to various consumer needs and preferences. Expanding beyond traditional passenger vehicles, Tesla has introduced the futuristic Cybertruck and the high-performance Tesla Roadster.

Elon Musk, the Key Figure of Tesla and EV World

Tesla's success and growth are largely due to Elon Musk's visionary leadership. Musk has been key in guiding the company's strategic decisions and fostering a culture of innovation. His influence has driven Tesla's rapid expansion and solidified its top position in the competitive electric vehicle industry. Under his direction, the company has used innovative strategies, like competitive pricing, which have significantly impacted its success in the electric vehicle sector.

Musk's indelible mark on Tesla is abundantly clear through the company's ongoing transformation and relentless growth. His visionary outlook and strategic decisions continue to shape Tesla's path and triumph, solidifying its position as a pioneering force in the electric vehicle arena. Musk's presence at Tesla is a testament to the critical role that leadership plays in charting a company's course in a highly competitive industry.

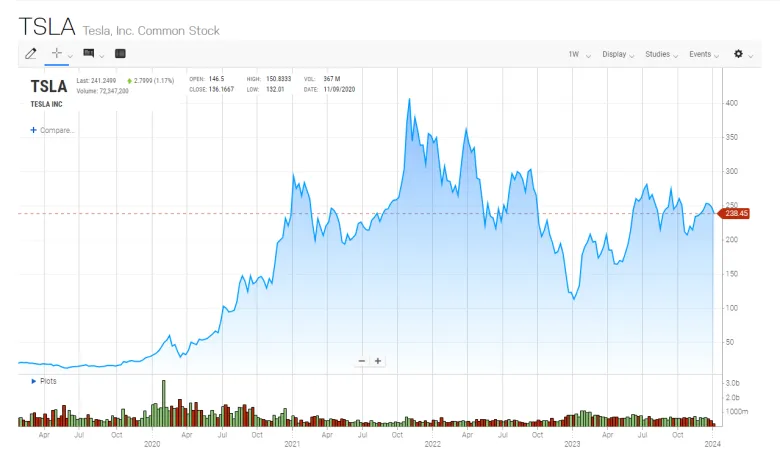

Tesla's Stock, Leading the USA's EV Companies

The chart of Tesla Inc. stock (TSLA) shows a dynamic three-year trajectory. Initially, the stock appears to be trading in a lower range with a modest uptrend. However, there's a noticeable steep spike that indicates a period of rapid growth. This spike may have been driven by significant company milestones, technology breakthroughs, or significant market interest. After the peak, the stock exhibits volatility with several peaks and troughs, indicating investor reactions to various events or financial reports.

The recent performance of Tesla stock, as shown in the chart above, shows a period of volatility following a period of rapid growth. The stock has experienced highs and lows, but hasn't surpassed its previous high. This trend suggests continued investor interest in Tesla, but also points to potential factors causing market uncertainty or instances of profit taking. The volume bars, while less dramatic than the price changes, also show fluctuations that likely reflect the stock's price movements. More recently, the stock price appears to be consolidating with reduced volatility, suggesting that the market may be reaching a consensus on Tesla's value given its current prospects.

Rivian, The Rising Star in the USA's Top Electric Cars Companies

Rivian, founded in 2009 and based in California, has rapidly emerged as a key innovator in the electric vehicle (EV) market, producing electric SUVs and pickup trucks on a versatile "skateboard" platform. This platform is foundational not only for their current vehicles but also supports future models and can be adopted by other companies for their EV designs. Rivian's first two products, unveiled in December 2017, were the R1T, an electric five-passenger pickup truck, and the R1S, an electric seven-passenger SUV. Both vehicles are designed for rough terrain and semi-autonomous driving, with full autonomy planned for future models.

In addition to these vehicles, Rivian entered into an agreement with Amazon in February 2019 to design, produce, and deliver 100,000 electric delivery vehicles (EDVs) by 2030. These vans are being built in three sizes and are exclusively for Amazon, aligning with Amazon's plan to transition its delivery fleet to 100% renewable energy by 2030. Rivian is also developing the R2, a smaller, less expensive SUV expected to launch in 2025, with a pickup truck version of the R2 also under consideration. This new model will be assembled at Rivian's upcoming factory in Georgia, highlighting the company's continued expansion and innovation in the EV space.

R.J. Scaringe making Rivian's Rise in the New Era of USA Electric Car Companies

Robert Joseph Scaringe, known as R.J. Scaringe, is the visionary founder and CEO of Rivian, an innovative American electric vehicle manufacturer. Born on January 19, 1983, in Melbourne, Florida, Scaringe's passion for cars started early in life, leading him to restore vehicles in his neighbor's garage. This passion evolved into a commitment to sustainable transportation, shaping his academic and professional path. He holds a bachelor's degree in mechanical engineering from Rensselaer Polytechnic Institute and further advanced his expertise with a master's and a doctorate in mechanical engineering from the Massachusetts Institute of Technology (MIT).

Under Scaringe’s leadership, Rivian, originally founded as Mainstream Motors in 2009 and rebranded in 2011, has made significant strides in the electric vehicle industry. Scaringe has been instrumental in the development and launch of Rivian's flagship electric vehicles, the R1S and R1T. His recent decision to directly oversee product development aligns with Rivian's strategy to innovate and expand, particularly as the company gears up for the launch of its new R2 vehicle line. Scaringe's approach combines his engineering expertise with a visionary outlook, driving Rivian towards becoming a key player in sustainable mobility. On the personal front, Scaringe is married to Meagan McGone and they have three children, emphasizing his role not just as a business leader but also as a family man.

Rivian's Stock Journey in the USA

Over the past three years, Rivian Automotive, Inc.'s stock trajectory has been emblematic of the electric vehicle industry's volatility and the growing pains of a new market entrant scaling up operations. Rivian, which captured the market's attention with its high-profile IPO at the end of 2021, saw its stock price reach peak levels as investor enthusiasm surged for electric vehicles. However, the initial excitement was tempered by the realities of manufacturing complexities, supply chain issues, and the herculean task of establishing a solid foothold in the competitive automotive industry.

As of late 2023, the stock price reflects a significant retreat from its post-IPO highs, a consequence of market recalibration and Rivian's operational challenges. The trading volume spikes, occasionally visible in the accompanying chart, likely correspond to the company's financial reports, strategic announcements, and industry-wide news affecting investor sentiment. Despite the downward pressure on its stock price, Rivian remains a closely watched player in the electric vehicle space, with market observers keenly anticipating its next moves in innovation and production efficiency.

Lucid Motors, The USA's Luxury Electric Cars Market

Lucid Motors, founded in 2007 and headquartered in Newark, California, has established itself as a major player in the electric vehicle (EV) industry. Specializing in electric luxury sports cars and grand tourers, Lucid Motors not only designs its vehicles in California but also manufactures them in Arizona, emphasizing its commitment to American-based production. Lucid's journey in the EV space began with a focus on developing their own battery system, which forms the core of their EV technology, aimed at achieving high performance, safety, and durability.

Lucid Motors introduced its first vehicle, the Lucid Air, in several trim levels, including the Lucid Air Pure, Air Touring, and Grand Touring models, with the latter available in a Performance equipment level. The Lucid Air is notable for its impressive range and power, with the US Environmental Protection Agency rating its range at 520 miles on a single charge. The 2022 Lucid Air Grand Touring model, unveiled in November 2021, features two electric motors that combine for 819 hp and 885 lb-ft of torque. In addition to the Lucid Air, the company is set to launch its second model, the Lucid Gravity SUV EV, in 2024. The Gravity SUV, officially unveiled at the 2023 Los Angeles Auto Show, is anticipated to offer a 440-mile range, a dual-motor electric powertrain, a 0-60 time of 3.5 seconds, and a starting price under $80,000, with deliveries expected in late 2024 for the 2025 model year.

Peter Rawlinson, Spearheading Innovation at Lucid Motors in the USA's New Electric Vehicle Industry

Peter Rawlinson holds the dual role of CEO and CTO at Lucid Motors, a company widely celebrated for its groundbreaking contributions to the electric vehicle (EV) sector. Under Rawlinson's adept leadership, Lucid Motors has achieved notable success within the luxury EV market, with special emphasis on their flagship model, the Lucid Air. His visionary guidance revolves around propelling the company's technological prowess and diversifying its product portfolio to cater to a wide range of consumer demands.

Lucid Motors, under the resolute and visionary leadership of Rawlinson, remains steadfast in its wholehearted commitment to delivering a wide array of exceptionally customizable and cutting-edge electric vehicles (EVs). This steadfast commitment becomes prominently evident through their ceaseless and tireless efforts to continually enhance the Lucid Air, effectively underscoring the company's unwavering and dedicated mission to seamlessly fuse opulence with the latest and most advanced EV breakthroughs. Rawlinson's central and irreplaceable position plays a definitive role in steering Lucid Motors towards a prominent and distinguished status within the intensely contested EV terrain.

Lucid's Stock, Situation among EVs Companies in the USA

Over the past three years, Lucid Group, Inc.'s (LCID) stock performance has been a rollercoaster of highs and lows, according to the chart provided. It began with a period of stability, then skyrocketed to a remarkable high, which may have been fueled by optimistic company news or market speculation. However, this high was short-lived, and the stock experienced a sharp decline shortly thereafter. Throughout the remaining period, the trend has been predominantly downward, indicating a loss of the initial momentum that drove the stock's value up.

The trading volume depicted by the bars at the bottom of the chart spiked significantly during the stock's most volatile periods, especially at the peak of its price. In more recent times, the stock has shown signs of stabilization, trading at a much lower level than its peak, which suggests a reevaluation of the stock's worth by the market. It's now trading near its lowest point in the observed timeframe, possibly establishing a new equilibrium based on the current investor sentiment and the company's performance within the broader market context.

Polestar, Electric Vehicles Company in the USA's Top Automotive Scene

Polestar, a prominent name in the automotive industry, particularly in the electric vehicle (EV) sector, has a rich history and a forward-looking vision. Established initially in 1996 as Flash Engineering, it was later rebranded to Polestar Racing and eventually became part of Volvo Cars in 2015. This marked a significant shift in its focus, transitioning from a racing brand to a global EV manufacturer. Today, Polestar stands out as Volvo's performance and electric-vehicle brand, signifying a blend of high-tech offerings and modern Swedish styling. The company is headquartered in Torslanda, outside Gothenburg, Sweden, and operates under the ownership of both Volvo Cars and the Chinese car manufacturer Geely.

Polestar's portfolio is diverse, including models like Polestar 2, Polestar 3, Polestar 4, Polestar 5 and Polestar 6, each showcasing a commitment to minimalistic design, technological innovations, and sustainable solutions. These vehicles are produced in China, the home of Volvo's and Polestar's corporate parent, Geely. The brand's philosophy revolves around using design and technology to drive society towards more sustainable mobility, reflecting in their range of electric performance cars. Available in 27 markets globally, including North America, Europe, and the Asia Pacific, Polestar has positioned itself as a significant player in the EV market. Although it may not be the most high-profile manufacturer in the EV race, Polestar is increasingly recognized as a formidable competitor, dedicated to improving society with cleaner, more sustainable transportation options.

Thomas Ingenlath, Leading Polestar's Vision of Companies in the USA

The CEO of Polestar is Thomas Ingenlath. He has been leading the company since 2017, bringing over 20 years of experience in design, innovation, and leadership in the automotive industry. Before joining Polestar, Ingenlath held significant roles at Volvo Cars, including Senior Vice President of Design, and had various design management positions at Škoda Auto and Volkswagen.

Under his leadership, Polestar is focused on using design and technology to drive the shift towards sustainable mobility. The company, headquartered in Gothenburg, Sweden, aims to create a climate-neutral car by 2030 and is known for its electric performance cars that combine avant-garde Scandinavian design with advanced technology. Polestar's current lineup includes Polestar 2 and Polestar 3, with plans to release more electric performance vehicles through to 2026.

Polestar's Stock Navigation

The Polestar Automotive Holding UK PLC (PSNY), a company that has garnered significant attention in the electric vehicle market, has had an intriguing journey in the stock market as depicted by its recent stock performance chart. The company's shares witnessed a substantial surge in value early in the period, a likely reflection of investor confidence bolstered by promising business prospects or industry-wide tailwinds.

However, the initial euphoria was met with a series of fluctuations, leading to an overarching downtrend in the stock's value. This decrease could be attributed to a variety of factors, including market corrections, competitive dynamics within the electric vehicle industry, or shifts in investor sentiment. Trading volumes peaked alongside these price movements, signaling active engagement from investors during these key periods. Currently, the stock price appears to have plateaued at a lower level, which may suggest that the market has reached a consensus on the company's valuation, taking into account its growth potential against prevailing economic conditions and sector-specific challenges.

Faraday Future, Innovating as a New EV Company in the USA

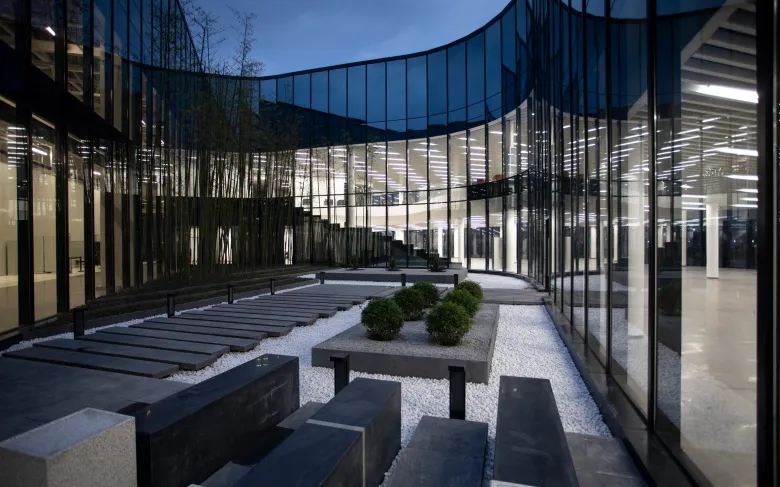

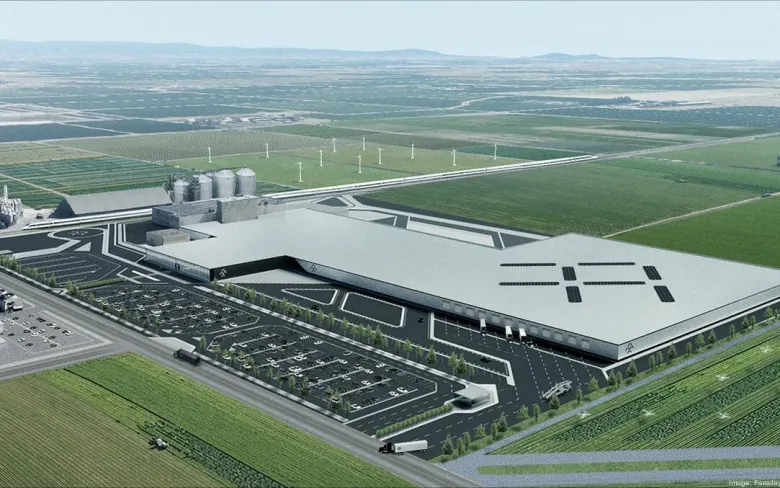

Founded in 2014, Faraday Future is an enterprising American startup in the electric vehicle industry, created by Chinese entrepreneur Jia Yueting. Based in Los Angeles, California, the company's name pays homage to Michael Faraday, the renowned English scientist pivotal in discovering electromagnetic induction, crucial to electric motor technology. Initially, Faraday Future embarked on ambitious projects, including a planned $1 billion investment for its first manufacturing facility in North Las Vegas. However, the company encountered early challenges, leading to a temporary halt in the facility's construction in 2016. This included exploring alternative ownership models, in-vehicle content possibilities, and advancements in autonomous driving technology.

One of Faraday Future's notable achievements is the FF 91, its first production vehicle, unveiled at the US Consumer Electronics Show in January 2017. The FF 91, a luxury 130 kWh crossover, impressed with its connected car features and high-performance capabilities, capable of accelerating from 0 to 60 mph in under 2.5 seconds. Despite a rocky demonstration, the FF 91 garnered over 64,000 reservations within 36 hours of its reveal. The production of the FF 91, featuring a tri-motor configuration and a 142 kWh battery pack for an estimated range of 381 miles under US EPA standards, began in March 2023 in Hanford, California. Deliveries are expected to commence later the same year. The FF 91 Futurist Alliance edition, limited to 300 units globally, is priced at $309,000.

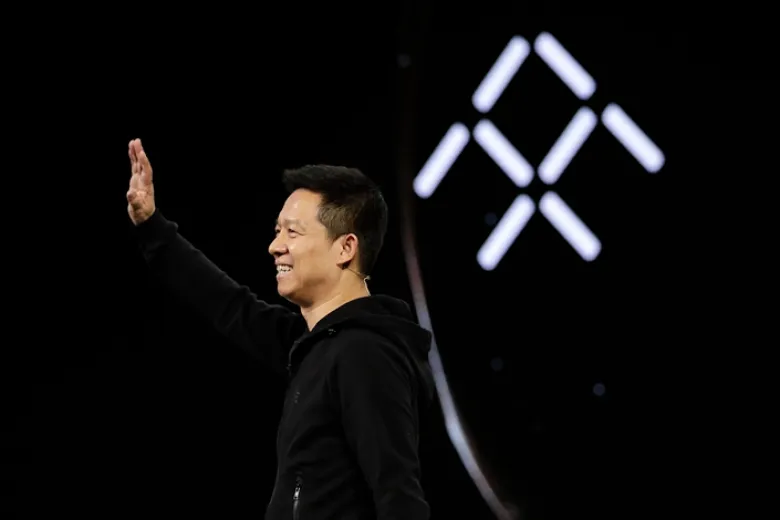

Jia Yueting's Path of U.S. Electric Vehicle Companies

Jia Yueting emerges as a noteworthy character in the narrative of Faraday Future, an electric vehicle startup. As the company's founder, he has wielded substantial influence over its evolution. However, despite his prominence within the organization, Jia Yueting has encountered a series of financial hardships and controversies. In 2017, he found himself entangled in a freezing order that impacted a substantial portion of his assets in China. This was subsequently followed by his declaration of Chapter 11 bankruptcy in the United States in 2019, prompted by mounting debts owed to numerous creditors.

In terms of his role at Faraday Future, Jia Yueting stepped down from the CEO position in 2019, subsequently serving as the company's "chief product and user ecosystem officer." However, his role was limited following an internal investigation into allegations of fraud. Despite these challenges, Jia Yueting continued to have an influence on the product and user ecosystem aspects of Faraday Future. The company has been through various changes in leadership and strategy, reflecting the dynamic and challenging nature of the electric vehicle industry.

Faraday Future's Stock, Emerging Among USA's Electric Car Companies

In an illustrative display of market dynamics, the stock performance chart of Faraday Future Intelligent Electric Inc. Warrant (FFIEW) captures a volatile period for the company. The chart begins with a moderate upward trend, subsequently leading to a pronounced spike. This significant increase in stock price may have been propelled by investor optimism or strategic corporate developments that momentarily boosted confidence in the company's future.

However, the ascent was followed by a stark decline, indicating a recalibration of the warrant's value by the market. This downturn could reflect reactions to Faraday Future's operational outcomes, shifts in the electric vehicle sector's landscape, or broader market sentiment. Post-peak, the stock exhibits a series of lesser fluctuations, with trading volumes peaking in tandem with these price movements. In the latter part of the chart, the price levels off significantly, settling at a lower valuation. This plateau suggests a market consensus emerging around the company's prospects, tempered by an assessment of the inherent risks and potential within the evolving electric vehicle industry.

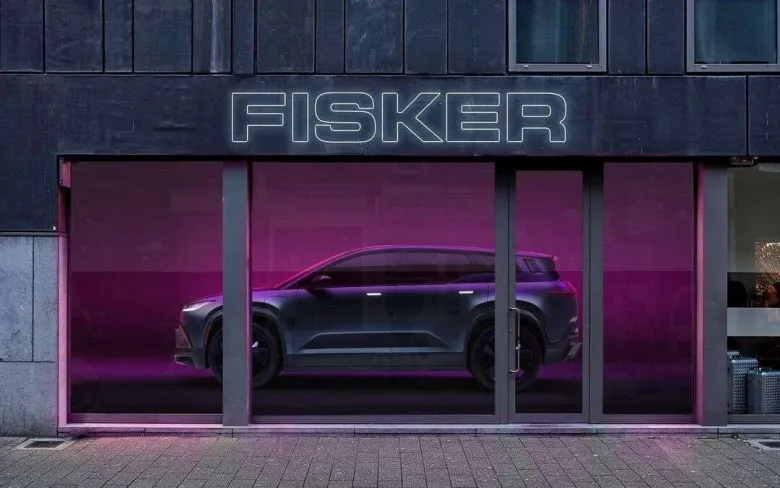

Fisker Inc., Designing New Cars as a Top Company

Established in 2016 by Henrik Fisker and Geeta Gupta-Fisker, Fisker Inc. stands as a prominent entity in the American electric vehicle (EV) sector, with its base in Manhattan Beach, California. As a progressive successor to Fisker Automotive, the company is at the forefront of EV innovation, actively shaping the dynamic EV landscape in the USA. Fisker Inc. diversifies its operations into three main segments: The White Space, The Value Segment, and The Conservative Premium, reflecting a multifaceted strategy in the electric car market. With a dedicated team of 1,300 employees, Fisker Inc. is recognized for its pioneering asset-light automotive business model and its versatile platform-agnostic design methodology, which are central to its mission of developing premier electric vehicles.

One of Fisker Inc.'s flagship models is the Fisker Ocean, an electric sport utility vehicle (SUV) with an estimated range of 300–350 miles. The Ocean, announced in 2019, is intended to lead a lineup of mass-market all-electric vehicles. It features options for both rear- and all-wheel drive, a lithium-ion battery pack of approximately 80 kWh capacity, and a solar panel roof that serves as a range extender, adding an extra 1,500 miles of range annually. The design of the Ocean emphasizes sustainability, utilizing a significant amount of recycled materials. Another model, the Fisker Pear, is an "urban" electric vehicle set at a competitive price of $29,900 before taxes and incentives in the U.S. The production of the Pear, planned at Foxconn's facility in Lordstown, Ohio, aims for an initial annual target of 250,000 units. Additionally, Fisker Inc. has unveiled two more models in 2023, the Ronin and the Alaska, further expanding its portfolio of electric vehicles.

Henrik Fisker and Dr. Geeta Gupta-Fisker, Leading Fisker to the Top of USA Companies

Henrik Fisker is a renowned Danish automotive designer and entrepreneur based in Los Angeles, California. He is best known for designing luxury cars and has a significant history in the automotive industry. After working at BMW, Ford, and Aston Martin, Fisker founded Fisker Automotive in 2007. The company, however, faced challenges and declared voluntary bankruptcy in 2013. Fisker is not affiliated with Karma Automotive, the successor of Fisker Automotive. In 2016, he launched Fisker Inc., introducing vehicles like the Fisker Ocean, and has been involved in various innovative projects including the development of electric vehicles and battery technology.

Dr. Geeta Gupta-Fisker, who happens to be married to Henrik Fisker, assumes dual roles of utmost importance within Fisker Inc. – that of Chief Operating Officer and Chief Financial Officer. Her contributions have been pivotal, as she played a key role in the acquisition and transfer of Fisker trademarks and associated goodwill to Fisker Inc. back in 2016. Dr. Gupta-Fisker boasts an impressive background in both technology and finance, overseeing the management of the Fisker family's business and investments. She also served as an investment advisor at the Alfred Mann Foundation. Prior to her co-founding of Fisker, her career path included significant roles in investment within a multibillion-dollar family office in London, and she joined Lloyds Banking Group in 2004. Notably, she embarked on her professional journey as an academic, commencing with her time at the University of Cambridge, UK, where she earned her PhD in Biotechnology in 2001. She furthered her academic pursuits with a post-doctoral Fellowship at Cambridge in 2004.

Fisker's Stock Dynamics

The Fisker Inc. (FSR), known for its foray into the electric vehicle market, has displayed a notable pattern of fluctuation in its stock price over the past three years. The company's journey on the stock market started with a relatively stable period, which was eventually succeeded by a phase of pronounced peaks. These surges in stock value may have been influenced by investor optimism spurred by key announcements or perceived industry opportunities. However, these were short-lived as each peak was followed by a notable decline, suggesting that the driving factors behind the surges were not sustained, or the market's expectations adjusted in response to operational realities.

In the latter half of the three-year span, the general trajectory of Fisker's stock has trended downwards, with its price gradually diminishing from the highs of earlier periods. This decline could be indicative of the market reassessing Fisker's long-term potential and positioning within the competitive landscape of the electric vehicle industry. Trading volumes have mirrored the stock's volatility, with spikes in activity coinciding with significant price movements. Currently, the stock appears to have leveled out, albeit at a lower valuation, perhaps reflecting a more cautious investor sentiment as the company navigates the challenges and opportunities ahead.

Electric Vehicle Sales in the USA

| Manufacturer/Model | USA Sales 2021 | USA Sales 2022 | USA Sales 2023 |

|---|---|---|---|

| Tesla | 301,998 | 506,069 | 498,000 |

| Tesla Model Y | 161,529 | 195,447 | 272,000 |

| Tesla Model 3 | 121,610 | 143,728 | 196,169 |

| Tesla Model S | 11,555 | 35,000 | 15,905 |

| Tesla Model X | 7,306 | 11,930 | 30,000 |

| Tesla Cybertruck | No Sales | No Sales | No Sales |

| Tesla Roadster | No Sales | No Sales | No Sales |

| Rivian | 920 | 10,699 | 36,202 |

| Rivian R1T | 920 | 9,900 | 16,011 |

| Rivian R1S | No Sales | 800 | 17,336 |

| Lucid | No Sales | 1,949 | 2,191 |

| Lucid Air | No Sales | 1,949 | 2,191 |

| Polestar | No Sales | 6,729 | 8,529 |

| Polestar 2 | No Sales | 6,729 | 8,529 |

| Polestar 3 | No Sales | No Sales | No Sales |

| Polestar 4 | No Sales | No Sales | No Sales |

| Polestar 5 | No Sales | No Sales | No Sales |

| Polestar 6 | No Sales | No Sales | No Sales |

| Faraday Future | No Sales | No Sales | No Sales |

| FF91 | No Sales | No Sales | No Sales |

| Fisker | No Sales | No Sales | 900 |

| Fisker Ronin | No Sales | No Sales | No Sales |

| Fisker Ocean | No Sales | No Sales | 900 |

| Fisker Pear | No Sales | No Sales | No Sales |

| Fisker Alaska | No Sales | No Sales | No Sales |

The Impact of Electric Car Companies on the USA's Automotive Landscape and Stock Market

The electric vehicle (EV) sector in the United States represents a significant turning point in both the automotive industry and the stock market. Driven by a blend of new and established electric car companies, this sector is rapidly redefining the landscape of American transportation. These companies, armed with groundbreaking EV technology, are shifting the focus towards eco-friendly and technologically advanced vehicles. Their emergence has not only revolutionized vehicle manufacturing but has also captured the attention of stock market investors. This growing interest in electric car stocks is a clear indication of a broader societal shift towards environmental sustainability and innovative transportation solutions.

In the competitive and innovative market of electric vehicles (EVs), top electric car companies in the USA, including new entrants, are relentlessly pushing the boundaries of electric mobility. These companies play a critical role in shaping the national economic framework and influencing global automotive trends with their advanced developments in EV technology. The stocks of these electric car companies, pivotal in the rapidly expanding EV sector, have become significant indicators of progress in green technology and present unique investment opportunities. As the USA leads this transformative movement, these companies are not only redefining the future of the automotive industry but also driving economic growth and sustainable development worldwide.

FAQs about Electric Car Companies in the USA

As of the latest information available up to April 2023, Tesla holds the leading position in the electric vehicle (EV) market. Tesla has been pivotal in advancing EV technology and has a significant share of the market, thanks to its popular models like the Model S, Model 3, Model X, and Model Y. While Tesla is the most prominent, it's important to remember that the EV industry is dynamic, with several other companies rapidly emerging and contributing to the sector's growth.

Determining the u0022bestu0022 electric car can vary based on individual preferences and needs. Factors such as range, performance, price, technology, and brand reputation play a crucial role. As of my last update in April 2023, Tesla is often cited for its high-performance and long-range vehicles, making it a popular choice among consumers. However, other brands like Rivian, Lucid Motors, and traditional automakers like Ford and Volkswagen are also offering competitive and innovative electric vehicles. It's recommended to consider specific requirements like budget, usage, and desired features to identify the best electric car for your needs.

As of early 2023, Tesla faces competition from several companies in the electric vehicle (EV) sector, but its biggest competitor is often considered to be Volkswagen. Volkswagen has been aggressively investing in EV technology and aims to surpass Tesla's production numbers in the coming years. Other notable competitors include traditional automakers like General Motors and Ford, which are rapidly expanding their EV lineups, as well as newer companies like Rivian and Lucid Motors, known for their innovative electric vehicle designs and technology. The competition is dynamic and varies across different markets and segments within the EV industry.

As of 2023, the number of Electric Vehicle Manufacturing businesses in the US has reached 260, marking a 12.5% growth from the previous year, 2022.

For a deeper dive into the world of electric vehicles, take a look at the article of the Rivian Amazon Van which offers a detailed look at EVs. Additionally, we made the article about the Hummer EV Crab Walk.