Full $7,500 Tax Credit Now Available for New Tesla Model 3s!

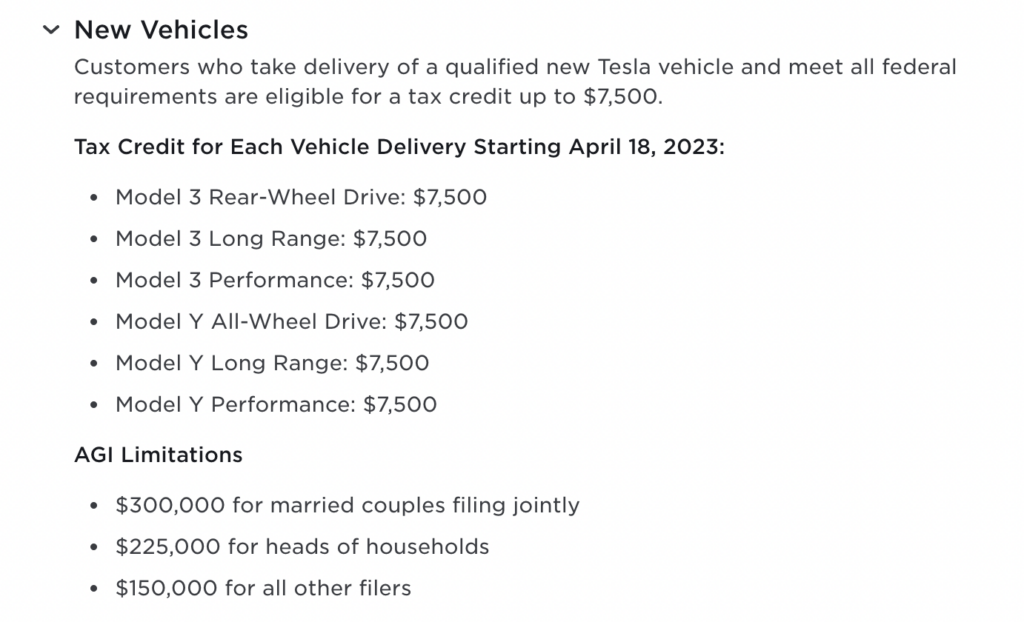

Tesla has updated its website to inform that every newly purchased Tesla Model 3 vehicle will now be eligible for the complete $7,500 federal tax credit for electric vehicles.

Last August, Congress mandated the EV tax credits under the Inflation Reduction Act. The credits aim to eliminate the country's dependence on China for batteries. The complete tax credit of $7,500 is divided into two parts. Electric vehicles can receive half of the credit, which is $3,750, if half of the battery components' value is produced or assembled in North America. The other half of the credit requires 40% of the critical materials' value to be sourced from the U.S. or any other free trade agreement country.

The Treasury Department delayed publishing battery sourcing guidance to allow EV-makers to comply with the requirements when the tax credits began on January 1. However, on April 18, the department enforced the critical material sourcing requirement, causing many vehicle models to lose their full tax credits.

Tesla's Model 3 saw its full credit reduced by half, while other automakers such as BMW, Rivian, and Hyundai lost their credits entirely. Fortunately, all Tesla vehicles are now eligible for the full $7,500 credit.

Before, only the Model 3 Performance was eligible for the complete tax credit. However, now both the Model 3 long-range all-wheel drive and rear-wheel drive are also qualified, along with the Tesla Model Y. With this tax credit, the Model 3 rear-wheel drive now starts at $32,740.

Tesla has not disclosed what caused the change, however, the CEO of the company, Elon Musk, retweeted a screenshot of the website that exhibits the tax credits available for every vehicle. It is noteworthy that the Treasury Department's website has not yet been updated to demonstrate Tesla's eligibility for tax credits.

2024 Tesla Model 3: What You Need to Know

| Year | Body | Trim | Range | Price |

|---|---|---|---|---|

| 2024 | Sedan | Rear-Wheel Drive | 272 | $38,990 |

| 2024 | Sedan | Long Range | 341 | $47,740 |